Lease Classification and Accounting

- RIT/

- Office of the Controller/

- Accounting & Reporting/

- Property Accounting/

- Lease Classification and Accounting

Purpose

Rochester Institute of Technology adopted the Financial Accounting Standards Board (FASB) new accounting guidance on leases FASB Accounting Standards Codification Section 842 ("ASC 842") on July 1, 2020.

This policy is intended to differentiate the appropriate classification of leases and document authoritative literature for the accounting treatment for leases by the lessee and lessor. The Controller’s Office is responsible for classifying leases in the year of their origination in accordance with the applicable financial accounting guidance. The Controller’s office is also responsible for accounting for all leases during the life of the lease in accordance with the applicable financial accounting guidance.

ASC 842 requires the University to determine whether a contract contains a lease before deciding on the appropriate accounting treatment. If the agreement contains a lease, it must be classified as either an operating or a finance lease and, as lessor a sales-type, direct finance or operating. The appropriate object code must be used for transactions related to the lease. The guidance follows a ‘right of use model’ (ROU) which essentially recognizes a ROU asset and lease liability at inception for all leases with exemption for leases with terms less than 12 months.

Policy

Long-term contracts (terms greater than 12 months) and total lease term value, including more than likely options to extend, of $50,000 or greater, will be assessed using the ASC 842 guidance to determine whether or not there is a lease component.

Lease classification is imperative to properly account for contracts that meet the criteria of Topic 842. The RIT Procurement Services Office (PSO) plays an important role in the lease determination process, as nearly all vendor contracts are executed through PSO. Property Accounting collaborates with PSO in final determination if the contract contains a lease and appropriate classification of the lease. Departments should contact PSO upon initiation of a contract.

Contact Information:

Controller's Office - Property Accounting -> propertyacctg@rit.edu

Controller's Office - Procurement Services Office -> purchsae@rit.edu

Procedure

PSO reviews approved requisition in Oracle for compliance with Procurement policies. This entails reviewing the contract from the supplier and ensuring proper review by the Office of Legal Affairs (OLA), Risk Management, and/or the Information Security Office, as applicable. PSO will also review the contract for the presence of an identified asset as required by new accounting pronouncement (Ref ASC 842-10-15 does contract convey the right to control the use of an identified asset for more than 12 months in exchange for consideration).

Contracts with an identified asset will be entered in iContracts as a lease if the contract term is greater than 12 months and the total lease term value is greater than $50,000. PSO will identify the contract terms and amount, entering both the number of months and total contract amount in iContracts. PSO will highlight the corresponding text in the electronic copy of contract that is stored in iContracts, evidencing the identified asset or reference page numbers in the notes field.

After PSO enters the information in iContracts, the software has workflow functionality that routes the contract for review by Property Accounting to confirm that a lease asset is present and if so, classify the lease as appropriate and record the proper accounting transactions.

The Financial Analyst Fixed Assets will receive workflow notification from iContracts to perform review of lease classification. Analyst will review and determine the following:

- Whether contract was properly classified as lease by PSO

- Assessment on decisions for lease criteria; identified asset, economic benefit, control of asset

- Identify lease classification (RIT as lessee – finance or operating; RIT as lessor – sales-type, direct finance, or operating)

- Account combinations for all respective lease types will use object code 76950 (lease expense) with the requisitioner’s department, FEC and project numbers. This will be adjusted to principal and interest expense payments on a monthly standard lease journal entry.

The Analyst will update the iContracts lease fields to reflect decision points noted above and trigger workflow back to PSO that the lease was reviewed and accounting combinations are provided.

Modifications to contract terms are captured in the iContracts contract field records and contract documents are retained in the system. Departments shall communicate to PSO any changes to contracts that they are made aware of. History is available to review contract modifications. PSO would trigger the accounting workflow within iContracts if contract changes prompted the need for further review to determine if any classification or valuation adjustments are warranted.

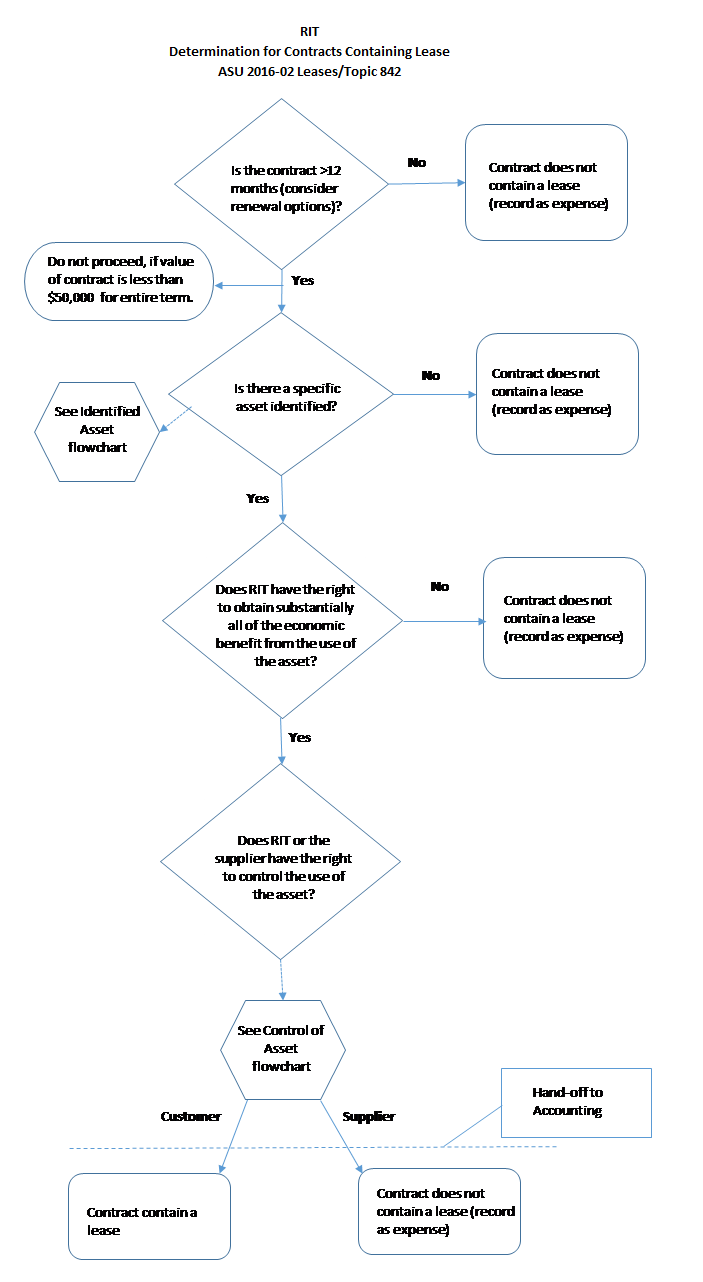

Does a Contract Contain a Lease?

Departments should have an understanding of whether a contract contains a lease. The following information summarizes the FASB guidance on determining if a contract contains a lease (both RIT as lessee and lessor).

Definitions:

- Lease - Present when a contract, or part of a contract conveys the right to control the use of an identified asset for a period of time in exchange for consideration.

Is there a specific asset identified?

- Identified asset - To meet the definition of a lease, an arrangement must require use of an explicitly or implicitly identified asset that is physically distinct.

- Explicitly specified asset - If a contract explicitly specifies the asset to be used (e.g., by serial number or a specified floor of a building), the contract contains an identified asset unless the supplier has substantive substitution rights.

- Implicitly specified asset - A contract that does not explicitly specify an asset to be used to fulfill the contract may implicitly specify the asset, for example, when the asset is made available for use. When only one asset can be used to fulfill the contract (e.g., because of economic or legal factors or because the lessor has only one asset available to perform under the contract) then the asset is considered implicitly specified.

- Physically distinct - An identified asset must be physically distinct. A physically distinct asset may be an entire asset or a portion of an asset. For example, a building is generally considered physically distinct. One floor within the building may also be considered physically distinct if it can be used independent of the other floors (e.g., point of entry or exit, access to lavatories).

- Certain assets may lend themselves to use by more than one party and need to be carefully evaluated to determine if they are physically distinct.

- When thinking about whether an asset is physically distinct, entities may need to consider the nature of the asset and evaluate how the asset was designed to be used.

- A customer can obtain economic benefits from use of an asset directly or indirectly in many ways, such as by using, holding, or subleasing the asset. (ASC 842-10-15-17)

- A customer may derive economic benefits from its use of an asset by producing goods for its own use or resale, providing services, or enhancing the value of other assets. The parties to the contract should consider the economic benefits that can be derived from the use of the asset but not benefits that are derived solely from ownership of the asset (e.g., proceeds from the sale of the asset).

- The right to determine how and for what purpose an asset is to be used is a strong indicator of which party directs the use of the identified asset because such rights determine the economic benefits that can be derived from using the asset during the period of use.

- Identify rights that are most relevant to changing how and for what purpose the asset is used (i.e., those that affect the economic benefits to be derived from the asset)

- Decisions about how and for what purpose an asset will be used are the most relevant factors to consider when assessing which party directs the use of the identified asset. A reporting entity should give the most weight to the factors that have the greatest impact on the economic benefit to be derived from that asset.

- If the supplier has the ability to alter the predetermined decisions, then the customer does not have the right to direct the use of the asset.

Lease Classification (Lessee)

If a lease meets any of the following five (5) conditions, it is a finance lease, otherwise it is considered an operating lease. (as Lessee)

A lease will be classified as a finance lease if any of the five following criteria are met:

- Transfer of ownership of underlying asset to lessee by end of lease term.

- Option to purchase underlying asset, that lessee is reasonably certain to exercise. "Reasonably certain" is a high level of probability that the University will exercise the option.

- Lease term is a “major part” of the economic life of underlying asset.

- ASC 842 does not require use of a standard indicator of "major portion", but an approach used widely as an indicator for a major part, is if the term of the agreement is equal to or greater than 75% of the underlying asset's remaining economic life.

- Land has indefinite live, so this criteria would not apply to leases of land.

- Leases commencing near the end of an underlying asset's economic life are exempt from applying this criteria. FASB indicates one approach to determine if this exception is applicable, when a lease commences in the final 25% of an asset's economic life.

- FASB ASC 842 defines "Economic Life" as either the period over which an asset is expected to be economically usable by one or more users or the number of production of similar units expected to be obtained from and asset by one or more users.

- The present value of the sum of lease payments and present value of any residual value not already in lease payment is > “substantially all” of the fair value of underlying asset

- ASC 842 does not require use of a standard indicator of substantially all, but one approach used widely as an indicator is payments are equal to or greater than 90% of the underlying asset's fair value.

- Underlying asset is of such a specialized nature that it is expected to have no alternative use to lessor at end of lease term

If the lease does not meet the criteria for classification as a finance lease, then it shall be classified as an operating lease.

Lease Classification (Lessor)

While lessees are now required to record a lease liability and right-of-use asset for all leases, the model applied by lessors depends upon the type of lease. Although lease accounting will not significantly change for most lessors, lessors may experience revenue recognition changes.

A lessor should determine lease classification based on whether the lease represents financing or a sale, as opposed to conveying usage rights, by determining whether the lease transfers substantially all the risks and rewards of ownership of the asset. The lessor should determine at the lease commencement if the lease transfers control of the asset. If there is no transfer of control, no selling profit or revenue should be recognized by the lessor. This is a change from the existing GAAP in that it aligns the concept of sale with the new revenue recognition standard.

The lessor should assess the lease classification using the criteria outlined in ASC 842 (same as for lessees).

If the lease satisfies at least one of the criteria below, the lessor has transferred control of the asset to the lessee and should classify the lease as a sales-type lease. However, if none of the criteria are met, the lease should be classified as a direct finance lease or an operating lease.

- Transfer of ownership of underlying asset to lessee by end of lease term.

- Option to purchase underlying asset, that lessee is reasonably certain to exercise. "Reasonably certain" is a high level of probability that the University will exercise the option.

- Lease term is a “major part” of the economic life of underlying asset.

- ASC 842 does not require use of a standard indicator of "major portion", but an approach used widely as an indicator for a major part, is if the term of the agreement is equal to or greater than 75% of the underlying asset's remaining economic life.

- Land has indefinite live, so this criteria would not apply to leases of land.

- Leases commencing near the end of an underlying asset's economic life are exempt from applying this criteria. FASB indicates one approach to determine if this exception is applicable, when a lease commences in the final 25% of an asset's economic life.

- FASB ASC 842 defines "Economic Life" as either the period over which an asset is expected to be economically usable by one or more users or the number of production of similar units expected to be obtained from and asset by one or more users.

- The present value of the sum of lease payments and present value of any residual value not already in lease payment is > “substantially all” of the fair value of underlying asset

- ASC 842 does not require use of a standard indicator of substantially all, but one approach used widely as an indicator is payments are equal to or greater than 90% of the underlying asset's fair value.

- Underlying asset is of such a specialized nature that it is expected to have no alternative use to lessor at end of lease term

A lessor should classify the lease as an operating lease unless the terms meet the two criteria for direct financing lease below.

A lessor should classify the lease as a direct financing lease if both of the following criteria are met:

- The present value of the sum of the lease payments and any residual value guaranteed by the lessee, not already reflected in the lease payments and/or any third party unrelated to the lessor, equals or exceeds substantially all of the fair value of the asset.

- It is probable the lessor will collect the lease payments plus any amount necessary to satisfy a residual value guarantee.

Lease Accounting

On the lease commencement date, a lessee is required to measure and record a lease liability equal to the present value of the remaining lease payments, discounted using the rate implicit in the lease using information available at the commencement date (or if that rate cannot be readily determined, the lessee’s incremental borrowing rate). Lease arrangements should be reviewed to ensure that all applicable payments are being considered.

At the commencement date, the cost of the right-of-use asset shall consist of all of the following:

- The amount of the initial measurement of the lease liability

- Any lease payments made to the lessor at or before the commencement date, minus any lease incentives received

- Any initial direct costs incurred by the lessee (as described in paragraphs 842-10-30-9 through30-10).

RIT's Property Accounting team is responsible for preparing the calculations and entries to record the initial lease measurement. Departments will use the following respective accounts to prepare purchase orders or invoice payments.

Finance Lease Accounting

Entry to record initial measurement upon valuation of finance lease components (performed by Property Accounting):

- Dr. Right-of-use asset

- Cr. Lease liability

- Cr. Cash (if first lease payment is made on commencement date)

Subsequent recognition and measurement:

Payment on lease:

- Dr. Lease liability

- Dr. Interest expense

- Cr. Cash

Amortization of ROU asset (straight-line over the shorter of the useful life of asset or lease term):

- Dr. Amortization expense

- Cr. Accumulated amortization ROU asset

Operating Lease Accounting (lessee)

Operating lease expense is recorded in a single financial statement line item on a straight-line basis over the lease term. This differs from finance lease expense recognition which is typically higher in the earlier years of a lease and declines over time.

Entry to record initial measurement upon valuation of operating lease components:

- Dr. Right-of-use asset

- Cr. Lease liability

- Cr. Cash (if first lease payment is made on commencement date)

Payment on lease:

- Dr. Lease expense (straight-line expense; total lease payments / total number of periods)

- Cr. Cash

Sales-Type Lease Accounting (lessor)

Since control of the asset is transferred to the lessee, the lessor should derecognize the leased asset and record the net investment in the lease at lease commencement. Contact Property Accounting if you believe you have such a transaction. They will review and facilitate the preparation of this type of transaction, if applicable.

- The net investment in the lease is the lease receivable plus unguaranteed residual asset, if any, measured at the present value discounted using the rate implicit in the lease.

- The lessor should recognize any profit or loss from the sale of the asset.

- Initial direct costs should be expensed unless the fair value of the asset equals its carrying amount (i.e. no profit or loss). When there is no profit or loss, the initial direct costs should be deferred and recognized over the lease.

Illustration of a journal entry for a sales-type lease:

- Dr. Lease receivable (present value of lease payments) 7,000

- Dr. Cash (lease payment paid at inception) 1,000

- Cr. Property, plant and equipment (net book value of asset) 4,500

- Cr. Gain on sale (profit from sale of the asset) 500

- Cr. Unearned interest revenue 3,000

Illustration of a journal entry for a sales-type lease:

- Dr. Cash 1,200

- Dr. Unearned Interest Revenue 180

- Cr. Lease receivable 1,200

- Cr. Interest revenue 180

Operating Lease (lessor)

Illustration of a journal entry for an operating lease:

- Dr. Cash (lease payment paid at inception) 2,400

- Cr. Rental Revenue 2,400

- Dr. Depreciation expense (leased asset) 450

- Cr. Accumulated depreciation (leased asset) 450

The subsequent entry is the same as the initial year.

Direct Financing Lease (lessor)

Contact Property Accounting if you believe you have such a transaction.

Lease Accounting - Ledger Accounts

The following accounts should be used when creating purchase orders for the respective lease agreements after PSO and Property Accounting have concluded on the treatment of the contract.

| Category | Object Code | Description |

|---|---|---|

| Operating Lease Liability | 38400 | ROU Operating Lease Obligation |

| Finance Lease Liability | 38300 | ROU Finance Lease Obligation |

Property Accounting will manage other accounts associated with the ROU asset and corresponding depreciation and interest (if a finance lease).

Ongoing Requirements

If departments or PSO experience the following scenarios after the lease has been recorded, the lease classification will need to be reassessed and adjustments to values recorded as applicable. Departments should contact PSO or Property Accounting.

- Change in assessment of lessee renewal, termination or purchase options

- Change in amounts probable of being owned under a lessee provided residual value guarantee

- Contingency resolved such that some or all variable payments become fixed

Annually the ROU assets recorded will need to be assessed for impairment by applying the long-lived assets. Departments may be contacted by Property Accounting to inquire about the identified ROU asset.