Travel Expense Report: Meals Per Diems

How to Enter Meals Per Diems in Oracle

- Log in to Oracle

- Select the RIT Reimbursement for Travel responsibility

- Click Request Expense Reimbursement

- Complete the Travel Reimbursement process until you reach the Cash and Other Expenses page

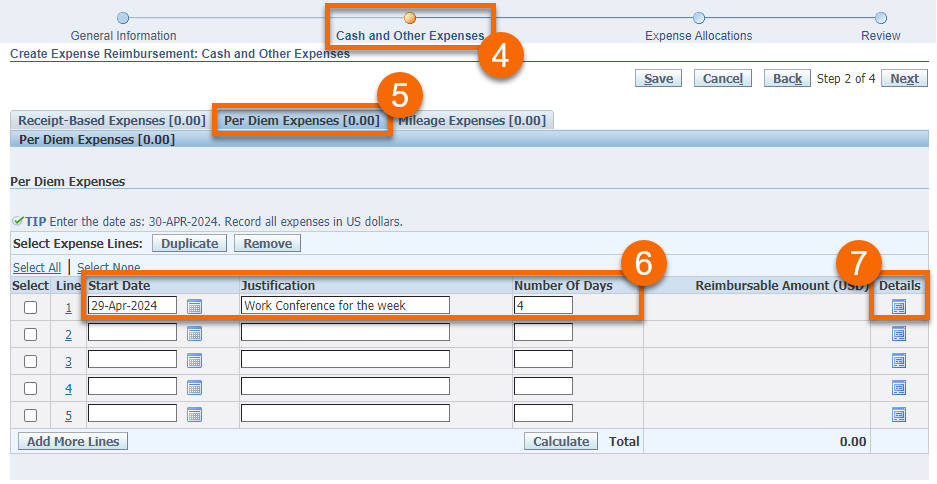

- On the Cash and Other Expenses page, select the Per Diem Expenses tab (refer to the screenshot below)

- To make a per diem entry, enter the start date, justification, and number of days

- Click the Details icon to view the Per Diem Details screen

Do not use Per Diem Expenses tab for receipt-based meal reimbursements or trips without an overnight stay.

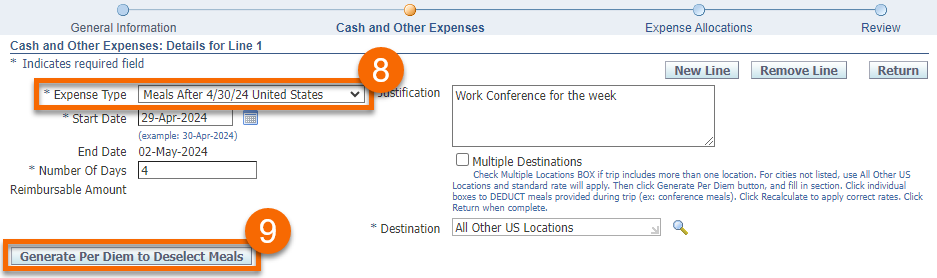

- In the Expense Type field, select the applicable per diem type (for example, Meals After 4/30/24 United States)

- Do NOT select the 'Meals Per Diem – Domestic or International' option unless your trip ended PRIOR to 5/1/2024

- If a trip spans across the effective date of 5/1/2024, RIT will honor the new GSA rates for the entire trip

- Click the Generate Per Diem to Deselect Meals button

Note that the reimbursable amounts will NOT automatically recalculate as changes are made on this screen. After making changes, remember to click the RECALCULATE button.

- Identify the Destination for the trip (if your city is not available in the search tool, use All Other US Locations as the destination)

- Exception to the Destination field: For cities in Alaska or Hawaii, instead use the State name

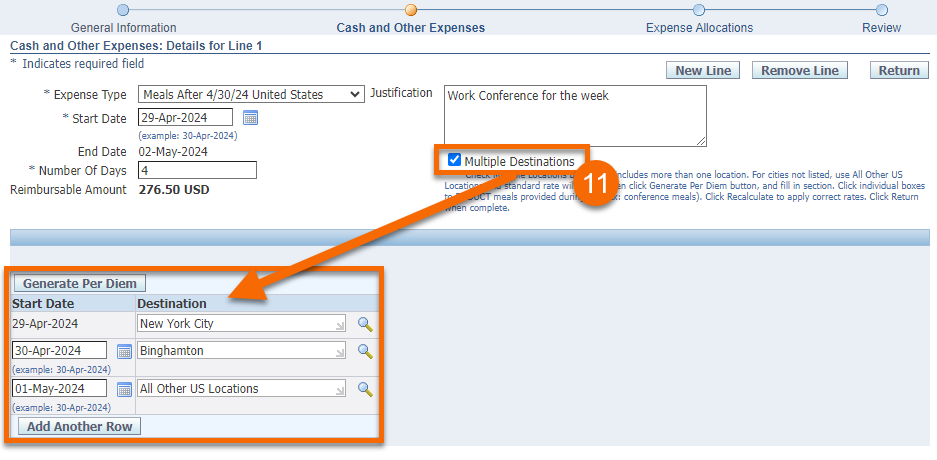

- If your trip includes more than one destination, place a checkmark in the Multiple Destinations box and follow these steps (a new section will appear on your screen):

- Enter the applicable start date(s) and destination(s) for each location

- Additional destinations can be added by clicking Add Another Row (note that rates for multiple locations will be applied based on the location of an overnight stay)

- Click Generate Per Diem after all dates and destinations have been entered

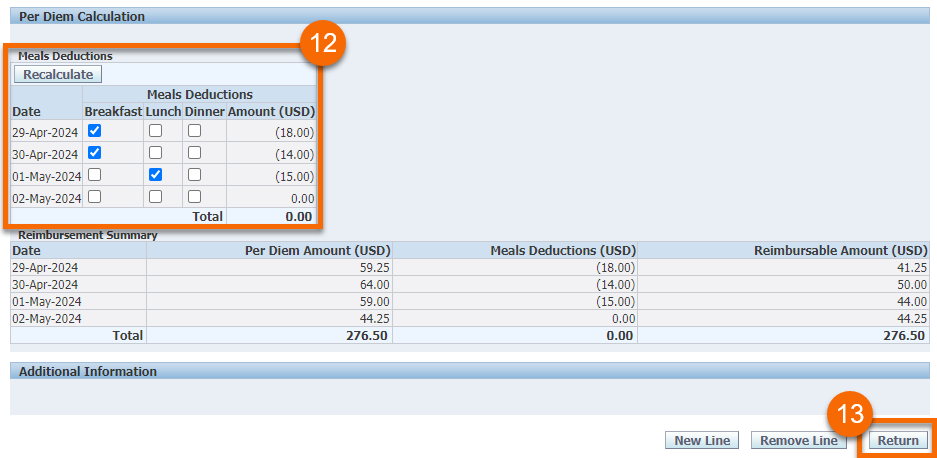

- In the Per Diem Calculation section, check the indicated boxes under Meals Deductions to indicate which meals were provided by other sources

- Remember to click the Recalculate button after making your changes to apply the correct meal deductions based on location rates

- Note that the First and Last days of travel will calculate at 75% of the location rate, less applicable meal deductions, to align with GSA practices

- Review the entire page for accuracy, then click the Return button to proceed with completing the expense report